How to Prevent Cloud

Costs Spiralling Out of Control

Managing costs associated with Cloud technology is something that many organisations struggle with – the UK public sector included – to the point where UK Treasury are rumoured to be intervening soon. We understand how easily this can happen; cloud technology can enable faster delivery, higher quality data, and AI-enabled services, but it can be very costly if not managed correctly.

It’s something that by my colleague, Julia Glidden (former VP, Worldwide Public Sector, Microsoft) highlights in her recent article – Cloud Burst or Bust in an AI Era – the lack of investment in delivering on the cloud strategy results in spiralling costs and, for some, a knee jerk reaction to cutting Cloud usage.

Often the reasons why things go awry is due to poor cloud architecture and a lack of rigorous FinOps. Here’s my recommendations for how to get back on track.

what really matters is having absolute clarity on your business goals, the needs of your users, and your technology preferences and constraints

Architecture Misalignment

Effective architecture serves as a key foundation of optimising cloud costs. It is the place where things often go wrong in terms of cost management if not designed well.

In my career, I’ve seen many instances where organisations are advised to use a sledgehammer to crack a nut, or in other words large-scale services like Dynamics or SharePoint, for example, are proposed to remedy problems that could be solved using a much lighter and more cost-effective architecture footprint through native cloud services.

I’ve seen lots of cases where organisations miss the opportunity to re-design systems for the cloud or take too many tactical decisions, instead taking a lift and shift approach (using virtual machines for example), which often results in higher cost expenditure in the cloud than on-premise. Fortunately, it’s not usually too late to move to better systems designs, and architecture can be often evolved iteratively via disciplined agile delivery approaches.

For example, I remember working with a client to replace a middleware solution because migrating it like-for-like from on premise to Azure would have required 50+ virtual machines and a huge monthly run cost. I worked with a small team to prototype an Azure integration layer that used serverless architecture and could be deployed at a fraction of the cost but also carried additional benefits, such as reduced infrastructure management, no recurring product license fee, and self-service integrations.

Cloud Governance

In the data and cloud world, costs can quickly spiral out of control if allowed to, and this is often a needless waste of money and resource.

It happens when data teams, for example, spin up resources or configure data platforms and pipelines for a specific need without realising the running costs have crept into thousands of pounds every month. This is easily done in the cloud without strong Azure platform knowledge, good governance and culture, and effective collaboration between teams.

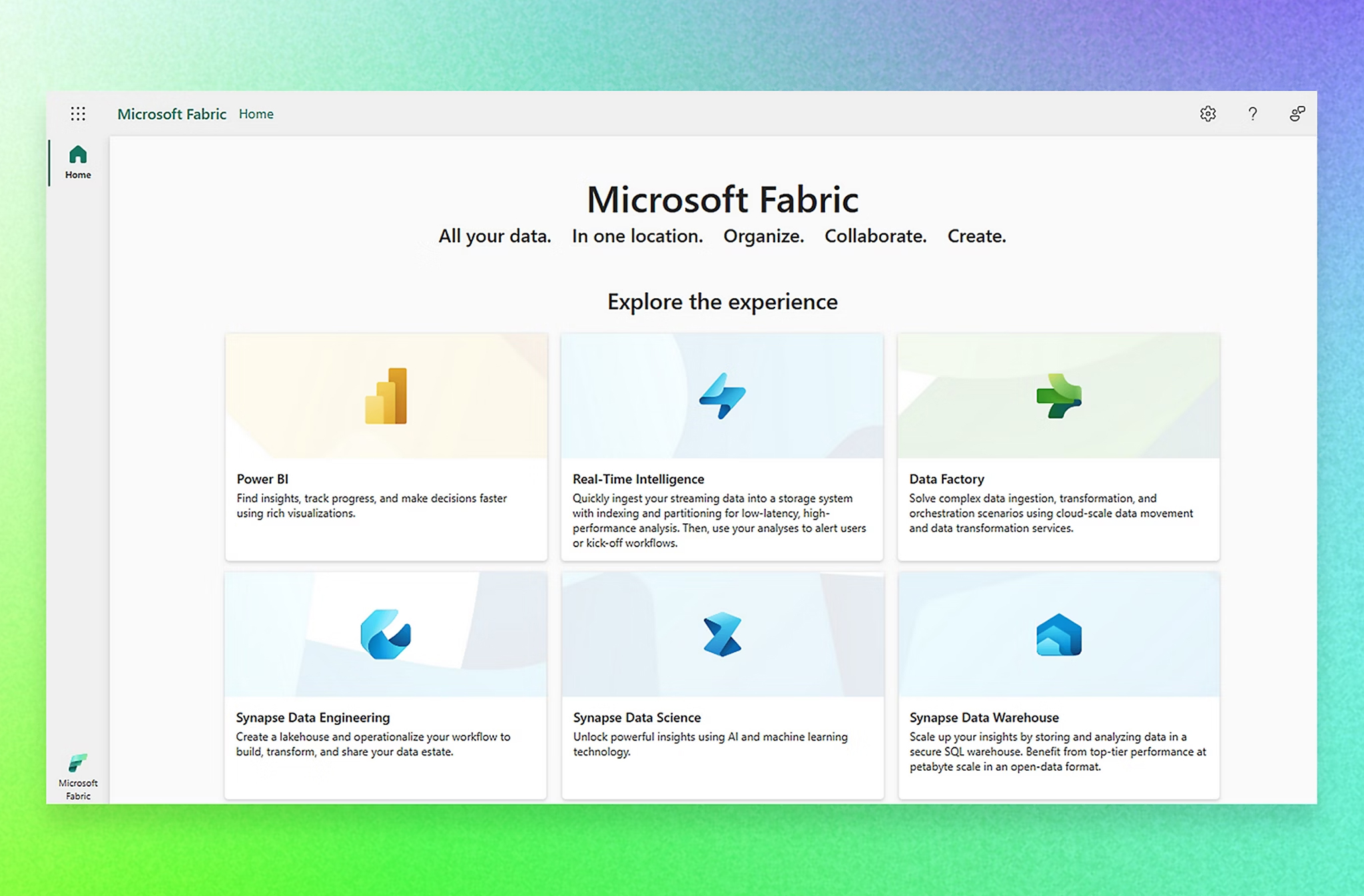

I’ve seen this problem exacerbated when data platforms like Databricks or Snowflake are installed (even when data teams just evaluate the different platforms) and left open to teams to experiment with. I don’t think it’s always made transparent or clear enough that significant cloud resources are required to run these platforms, depending on how they’re configured, and even simple trial periods can cost organisations thousands of pounds a month, which is a scary thought once extrapolated for a large, enterprise organisation.

I don’t think it’s always made transparent or clear enough that significant cloud resources are required to run these [data] platforms

I

Azure Architecture and Platform Knowledge

Whilst FinOps is an essential part of financial management in the cloud, it can be too late to make a big dent in costs when an organisation has already committed to the wrong architecture, so we see architecture and detailed Azure platform knowledge as key facets in designing and building cost effective data and cloud services (whilst also considering scalability, evolutionary changes, sustainability, security and performance etc.,).

At Pivotl, what really matters to us is having absolute clarity on your business goals, the needs of your users, and your technology preferences and constraints – generated through detailed, iterative discovery activities before providing architectural options, running technical spikes, and making concrete recommendations based on your unique context rather than providing expensive, boilerplate Microsoft reference architecture blueprints. This approach, coupled with extensive (broad and deep) Azure platform knowledge is what yields optimal solutions and paves the way to adopt FinOps disciplines such as spend controls.

we see architecture and detailed Azure platform knowledge as key facets in designing and building cost effective data and cloud services

FinOps

Cost optimisation is of course about much more than saving money, in my opinion it’s about value creation by using the cloud to maximise revenue streams or to deliver great data and AI-enabled services to users. FinOps is a discipline that blends financial management, cloud engineering, and development operations; it’s used to enable organisations to understand and make better decisions about their cloud expenditure.

FinOps typically involves using cost management tools like Microsoft Cost Management but is more than the sum of its parts (finance and DevOps) as it’s designed to permeate organisational culture to achieve maximum returns on their cloud investment.

In my experience, it’s a good idea to leverage tools like Power BI to support your FinOps reporting needs in near/real-time, and whilst good collaboration is essential to cost optimisation, Azure also needs to be set up correctly using role-based access controls, tagging, spend controls, and cost limits/alerts. To make technical configuration easier, there are open source pre-configured FinOps toolkits for Azure.

FinOps is about the wider organisation and its culture as much as it is about finance and DevOps practices

FinOps is about the wider organisation and its culture as much as it is about finance and DevOps practices

The need for an executive sponsor should not be underestimated as FinOps is about the wider organisation and its culture as much as it is about finance and DevOps practices and the technical configuration work required to put guardrails in place.

We often describe ourselves as the worst type of Microsoft partner, which without disparaging ourselves means that we don’t exist to sell large, expensive Microsoft services to our client base for the benefit of Microsoft and ourselves. Instead, we advocate for what is in our clients’ best interests – this means we design appropriately sized, cost–effective architecture services that are long-lived.

When being deliberate about designing strategic cloud architecture, in the context of the wider business and its culture, supported by a robust, disciplined approach to FinOps, an organisation can remove some of the risks associated with poor cloud experiences.

If you’re struggling with managing your cloud costs, please drop me a line at stuart.arthur@bepivotl.com or complete the form below for a chat about how we can help.